working in nyc living in nj taxes

As for NY vs. I work in New York City.

Live In Nj And Work In Nyc Where Do I Pay Taxes Streeteasy

I am not a CPA please consult with your personal accountant for more detailed information regarding your personal tax situation New York City requires all residents defined as a resident of one of the 5 boroughs to pay NYC local income taxes.

. Close to a wash NY State combined with NYC Income taxes NJ Income Taxes. Ive been a resident homeowner in New Jersey for nine years. You get 250000 per sale 500000 for a married couple.

However if you are an independent contractor you may not be subject to NY tax only NJ. Whether its learning about new industries or keeping updated with new and tricky tax regulations Gary Mehta prides on getting his clients the best tax advice. Which if youre working there is all of your income.

Say he paid 20k in NY taxes. Best of all you wont have to pay NYC income taxes which only apply to residents of New York City. But that same income.

Even with this NJ state tax usually comes out to be less than NY state tax in most cases. NJ income tax rates youll do somewhat better in New Jersey than in New York. But you will have to pay NYS which generally has higher taxes the difference.

You will have to file a tax return in both states. Ive lived in both NJ and NYC. Tax rates start at just 14 percent in New Jersey although this rate only applies to incomes under 10000 as of 2020.

Call us now to see how we can help. If you live in NJ you save the city tax but still will pay NY state taxes which will cover your NJ taxes. Your resident state will not tax you twice on the same income.

If you max your 401k thats lowered to 30. It represents about a 9 increase in my state taxes compared to living in New York. If your average tax rate was 40 before ie you kept 60 then now you keep 64 which is a 67 increase in take-home pay.

Notably sales tax in New York City is 8875 while in New Jersey the statewide retail sales tax is 6625. You have to have lived in the house as your primary residence two of the past five years. If you live in NYC you will pay NYS and NYC resident income tax no matter where you work.

New Jersey residents who work in New York State must file a New York Nonresident Income Tax return Form IT-203 as well as a New Jersey Resident Income Tax Return Form NJ-1040. Answer 1 of 2. It goes up much more than 4.

Yes you will pay taxes in both states if you live in NJ and work in NYC but you wont be double-taxed as you will receive credits for taxes paid. Residents of New Jersey who work in New York will fill out both an NJ Resident Income tax return and a NY Nonresident. If you live in NYC your effective all-in tax rate will be 34.

This is often enough to make. February 15 2021 1117 AM. In Jersey City NJ the sales tax is.

Answer 1 of 14. By living outside the city you save about 3-35 in nyc locality tax. Do your shopping at home.

However depending on where you live and your circumstances Ive found you may have to pay 250-450 for a monthly train pass into the city to commute. Click this link for more info on How to File a Non-Resident State Return. You pay the NJ income tax rate to NJ and then get a credit for what youve paid to NJ on your NYS return.

Set up an appointment to see us in person. I am being pursued by the New Jersey Division of Taxation to pay taxes from 2015 to 2019 in the amount of. NYC Income taxes only apply to resi.

If you only commute and work in NYC you owe NY State income taxes and receive a credit on your NJ Tax return. You will have to file in NJ and NYSNYC. Your employer will have withheld New York state taxes throughout the year but youll need to file in New Jersey as well.

Luckily there are maximum tax rates for both of these that you can pay and you can file for a tax return in New York City so you dont exactly pay double taxes. Answer 1 of 9. The city tax is 4 of gross that you now pocket instead.

Sales of a personal residence often have no capital gains tax as well. Sales tax is lower. As someone whos working in New Jersey you will also have to pay a state-level income tax for your income from New Jersey.

101 Hudson Street 21st Fl Jersey City New Jersey 07302 United States. You will have to file a tax return in both states. 23 days ago.

Therefore your wages would have to be reported on the New Jersey NJ and then a credit for taxes paid to another state would be used on the NY return. As a non-resident if you are an employee of a business you will not have to pay NYC taxes You get a credit for NJ purposes of the lesser of the amount of tax you would pay to NJ for the same income or what you paid to NY bu. You are not double-taxed.

New York NY does not have a reciprocal agreement with any state. If you physically work in New York you are subject to NY tax as a non-resident However you get credit on your New Jersey return for tax paid to New York. This means that if I lived in New Jersey Id pay slightly higher state taxes as compared to living in New York outside of NYC since I would be paying 100 of my previous New York State tax plus a little extra to New Jersey.

Live In Nj And Work In Nyc Where Do I Pay Taxes Streeteasy

Is Derek Jeter S Tampa Mansion A Tax Shelter Aol Real Estate Nyc Condo Florida Home Mansions

Steel Partition Room Divider 10 X 10 Cg Hardware Glass Partition Wall Room Divider Glass Room Divider

What Taxes Do You Pay If You Live In New York City Work In New Jersey Sapling

Seaside Before Sandy Casino Pier City Photo Seaside Aerial

Live In Nj And Work In Nyc Where Do I Pay Taxes Streeteasy

Latest News The Town Of Kearny Nj Kearny Ferry Building San Francisco Jersey City

If I Work In Ny But Live In Nj Do I Pay Taxes In Both States

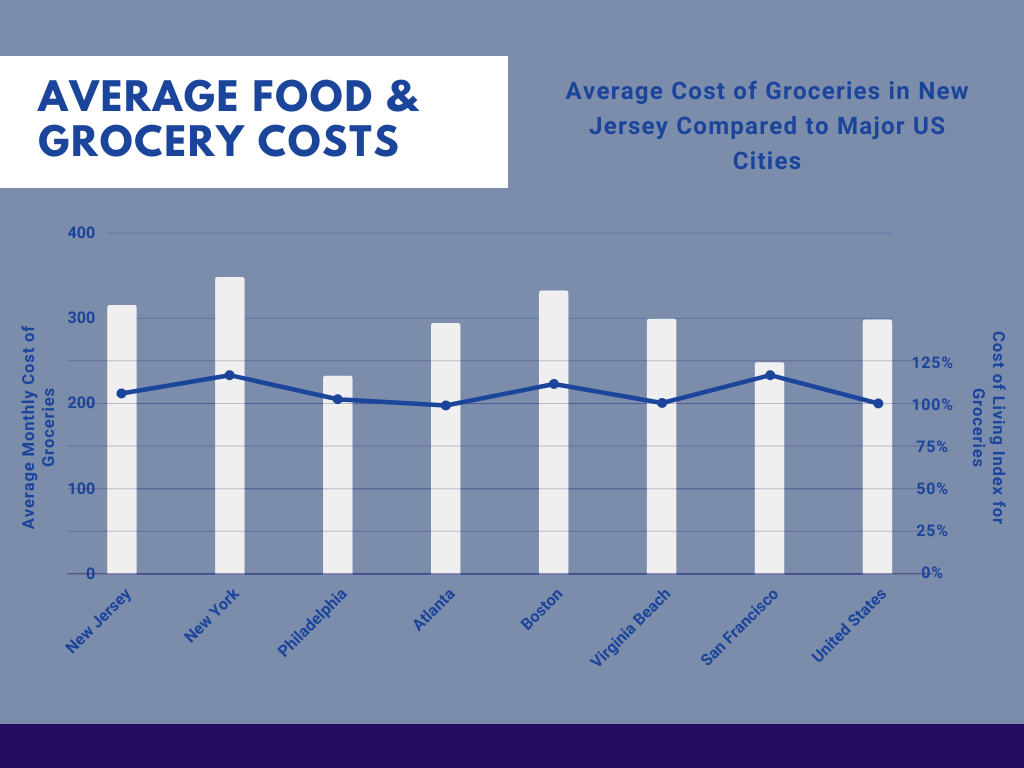

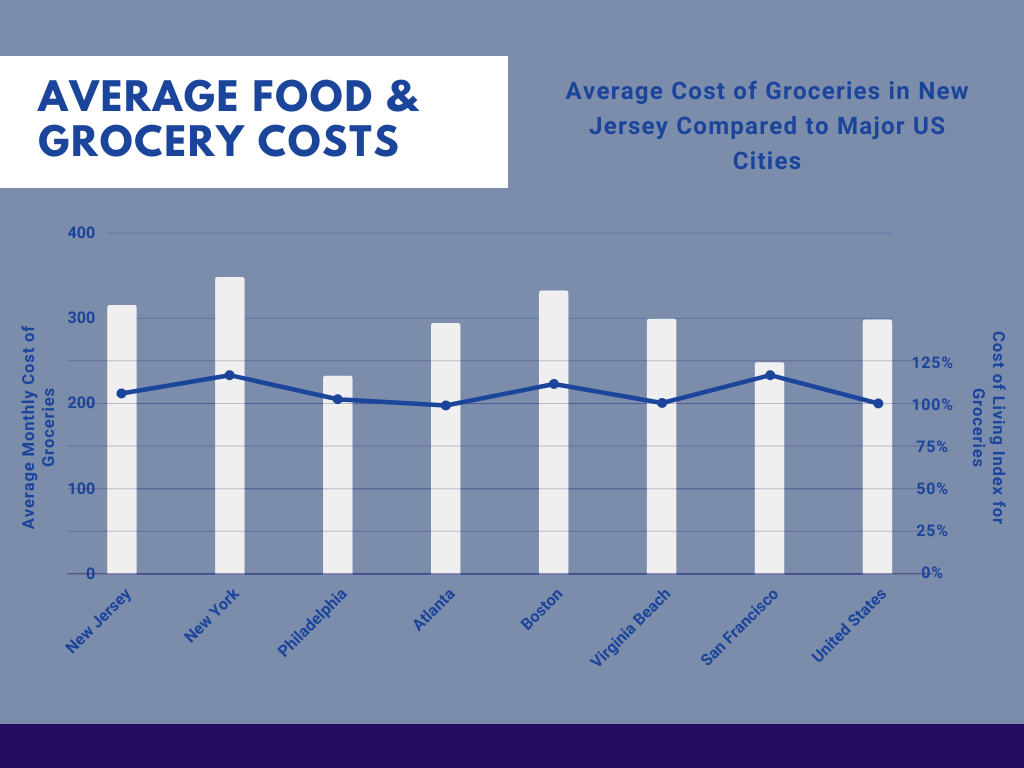

New Jersey Cost Of Living New Jersey S Living Expenses Guide

The Riverwalk In Edgewater Nj Favorite Places Bergen County River Walk

Amazon Opens Largest Fulfillment Center In N J Online Taxes Online Sales Fulfillment Center

Live In Nj And Work In Nyc Where Do I Pay Taxes Streeteasy

Mystic Island Nj Island Mystic Beach

New Jersey Cost Of Living New Jersey S Living Expenses Guide